The coronavirus pandemic has touched everyone in some way, but teachers are one of the groups who have experienced a lot of disruption and change. In many areas, schools closed abruptly with no indication when they would reopen. Teachers scrambled to revise lesson plans to work in a digital format, with students who run the gamut in terms of their access to technology and their ability to engage virtually.

Amid all this uncertainty, it’s hard to think about saving for retirement — especially for teachers just starting their careers and decades away from retirement. At this stage, many teachers are focused on paying off student loans, managing their budget and perhaps saving for a house. All of these are important. So why add another goal around retirement savings?

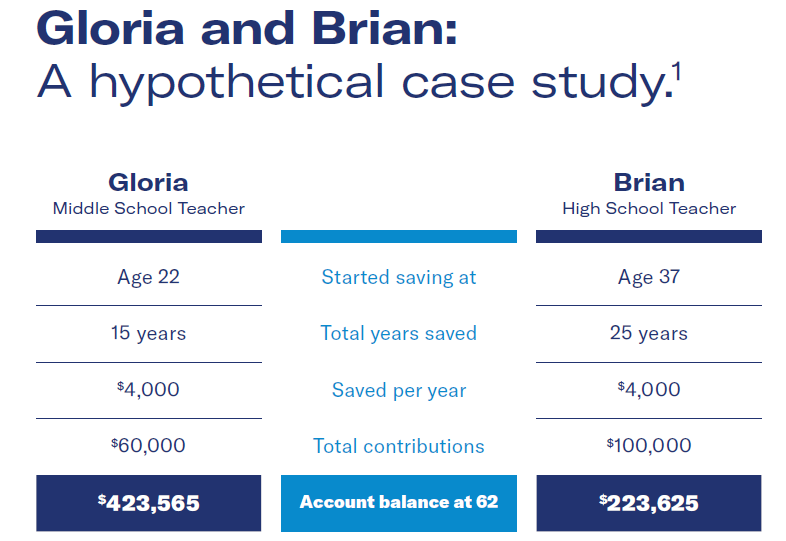

The short answer is that money saved early in your career can be worth more than money you save later. Because your money has more time to grow, you can potentially take less money out of your paycheck than a colleague who starts later, and still have more than they do when you retire. See Gloria and Brian’s example below on how that can work.

Ready to take the next step?

Talk to a financial professional to open a 403(b) plan. |

Equitable clients can: |

Why does Gloria have more money?

Because she had time on her side. While Brian contributed $40,000 more to his employer’s retirement savings plan, Gloria’s projected account balance at age 62 is almost twice as much as Brian’s. That’s because Gloria’s account will have more time to potentially grow by the time she retires — with each year’s gains reinvested to potentially generate their own gains. So, the sooner you start saving for your retirement, the more time your money will have to potentially grow tax free. Of course, a 403(b) can fit into any phase of your life. Everyone starts somewhere, and it’s never too early — or too late — to start.

Make it part of a plan

Starting to save for retirement can prompt a lot of questions. How much should I save? How should I invest it? How does this work with my pension? The best person to answer those questions is a financial professional who looks beyond your portfolio and thinks of the whole you.

There’s no such thing as a cookie-cutter financial plan that works for everyone. The best way to make the right plan for you, balancing what you need right now with what you’ll need in the future, is to work with someone who understands your lifestyle and your purpose, as well as your finances. The important people in your life, your favorite activities, charitable causes or social issues that are important to you — all of these elements and more should be considered as you decide how you want to save, spend and invest your money.

For now, of course, you’ll probably be meeting that person over the phone or in video rather than across a desk. Just like teachers, financial professionals are adapting to working virtually. But it’s easy to enroll in your school’s 403(b) retirement savings plan online, and then schedule an appointment online or over the phone.

With everything teachers are juggling right now, this can be one thing that’s simple. Your future self will thank you for taking steps now to secure your financial well-being.

Make sure a pension gap doesn’t impact your future vision. |

1 Assumes a hypothetical 6% annual potential rate of return. The 6% hypothetical rate of return is not based on the performance of actual investments or products. Actual rates of return will vary over time, particularly for long-term investments. Investments offering the potential for higher rates of return also involve a higher degree of risk. Actual results will vary. The amounts used in this hypothetical example do not take taxes or product-related charges into account.

Equitable is the brand name of Equitable Holdings, Inc. and its family of companies, including Equitable Financial Life Insurance Company (Equitable Financial) (NY, NY), Equitable Financial Life Insurance Company of America (MLOA), an AZ stock company with main administrative headquarters in Jersey City, NJ; Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI and TN); and Equitable Distributors, LLC.

GE-4866255.1 (07/2022) (Exp. 07/2024)

![]()