Considering life insurance for more than just funeral costs

In the United States today, 60% of the nation’s wealth is inherited or passed from one generation to the next. Yet that wealth is not spread equally among the different races in America. Sadly, only 8% of Black families enjoy the benefits of a financial inheritance.1

This is due to the fact that the Black community has faced numerous challenges in purchasing life insurance products and education over the years. Though the pandemic has increased awareness and demand for life insurance, many (including Black families) who don’t have life insurance still accept many common myths and misconceptions about it, such as thinking life insurance is only for burial costs, too expensive, or isn’t something they need.

The good news is, data suggests that Black families believe life insurance is important and a higher proportion of Black Americans own life insurance than they used to.2 In addition, 43% of Black Americans reported that they were currently working with a financial professional and a higher proportion of Black Americans than White Americans are currently looking for a financial advisor (30% vs 21%).2 An experienced financial professional can provide education, answer questions, and help understand life insurance they need to help build and protect their wealth for themselves and generations to come.

Thinking about life insurance in a new way.

When asked why they own life insurance, 66% of Black Americans cited burial or other final expenses as the major reason.2 While life insurance can certainly be used for funeral expenses, it can also provide other benefits that you may not have considered. For example:

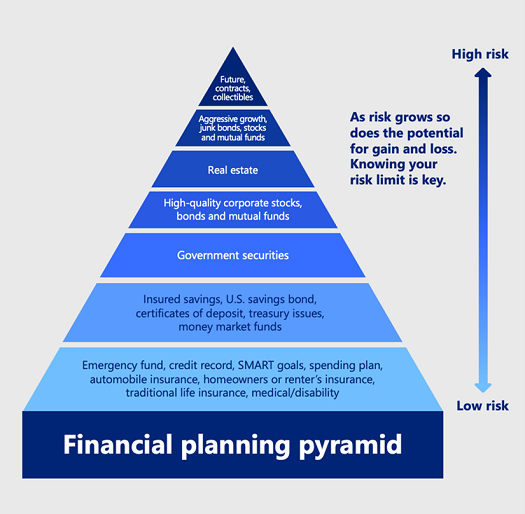

Life insurance is the foundation of a financial planning pyramid.

Healthy financial planning requires a healthy management of risk, and life insurance can be an essential wealth management strategy to help create family’s financial security and provide the education that comes with having peace of mind. While many Black families strive to attain financial empowerment, they tend to rely on high-risk investments, such as house flipping, stock ownership and entrepreneurship.3 These pathways can be an excellent way to build wealth. However, to build truly long term, personalized and generational wealth, a more holistic approach including life insurance is necessary.

Life insurance helps to enable generational wealth.

Taking out a life insurance policy is one of the easiest and most cost-effective ways to pass wealth along to loved ones. Whether you’re protecting your spouse from financial hardship if you were to pass away unexpectedly or you’re planning to provide a financial legacy for children or grandchildren, life insurance proceeds can be used to pay for anything from everyday expenses to college tuition, mortgage or a financial cushion.

Life insurance can be flexible.

As part of holistic life plan, life insurance can not only be used to protect loved ones from financial difficulty by paying off a mortgage or replacing lost income, but it can also be used in an estate plan, to protect a business and pass it along to the next generation or next owner. This is generally an income tax-free payout to your beneficiaries upon your passing, known as a death benefit. Some types of life insurance also allow for the potential to build cash value during your lifetime so you can use to pay for current expenses, such as supplement retirement income, paying for child’s college education or your own long-term care expenses. The ability to access this value is through loans and withdrawals. ** You may need to add a rider onto the policy to allow for withdrawals for long-term care coverage or critical care expenses.**

Debunking common myths.

One of the biggest misconceptions about life insurance is that it costs too much. When asked to estimate how much a $250,000 term life policy would cost a healthy 30-year-old, respondents greatly overestimate the cost, saying it would cost $500 per year, when on average the cost is closer to $165 per year. In addition to the cost, many Americans – including Black Americans – buy into common misconceptions about life insurance.4

- Myth: 29% of Black Americans believe the amount of life insurance recommended is too high and they don’t need that much.4

-

- Truth: Unfortunately, many Black Americans don’t have enough life insurance to truly build wealth for the next generation, much less provide financial stability for five, 10 or even 20 years for those left behind.

- Myth: 30% say they have life insurance through work and feel that’s enough.4

-

- Truth: Life insurance policies through employers often cover a year or two of salary only. Also, life insurance benefits provided through an employer are typically not portable, meaning you can’t take them with you when you leave that employer.

- Myth: 32% don’t think they can personally benefit from life insurance.4

-

- Truth: Depending on the type of life insurance, the policy owner can certainly benefit, though taking withdrawals or loans to pay for unexpected expenses, supplement retirement income or long-term care costs.

- Myth: 32% value hard work and don’t feel that anyone should get rich from their life insurance policy.4

-

- Truth: Life insurance isn’t about making someone rich. It’s about protecting those you love and helping them build wealth that they can then pass along to generations to come.

The importance of finding an experienced financial professional.

Black families, like many other Americans, often hesitate to purchase life insurance because they are unsure of how much or what kind they should own. That’s where an experienced financial professional can come in. The right professional can help you unravel the intricacies of life insurance and what it’s all about. But before they ever talk about products, a good financial professional will work to understand your situation, listen, learn, and build on your existing assets, respecting the choices you’ve already made. You can certainly look to them to help provide education on the options available to you and make clear recommendations to help you make your life’s most important decisions. A trusted professional will also help you follow your progress, and will stay in touch with you as your life progresses to ensure that you stay on track.

Equity. It’s in our name.

If you’re not sure where to start looking at life insurance, consider a company who has a long history of being a trusted bastion of support for Black families and communities.

Equitable Advisors has a diverse coalition of financial professionals to support, guide and stand behind Black Americans of all generations. If you don’t have a financial professional, consider one from Equitable Advisors.

1 Source: https://www.federalreserve.gov/econres/notes/feds-notes/recent-trends-in-wealth-holding-by-race-and-ethnicity-evidence-from-the-survey-of-consumer-finances-20170927.htm

2 Source: https://www.limra.com/siteassets/research/research-abstracts/2021/black-americans-life-insurance-ownership-and-attitudes–a-2021-insurance-barometer-supplementary-report/2021_blackamericanslifeinsurance_infographic.pdf

3 Source: https://www.credit-suisse.com/about-us-news/en/articles/media-releases/42428-201411.html

4 Source: https://www.limra.com/en/research/research-abstracts-public/2021/2021-insurance-barometer-study/

Policy loans and withdrawals will reduce the cash value and death benefit of the contracts. Clients may need to fund higher premiums in later years to keep the policy from lapsing. Under current federal tax rules, you generally may take income tax-free partial withdrawals under a life insurance policy that is not a modified endowment contract (MEC), up to your basis in the contract. Additional amounts are includible in income. The IRS places a limit on how much money can go into life insurance premiums for the policy and how quickly such premiums can be paid in order for the policy to retain all of its tax benefits. If certain limits are exceeded, a MEC results. MEC policyholders may be subject to taxes on distributions on an income-first basis, that is, to the extent there is gain in their policies, as well as penalties on any taxable amount if they are not age 59 1/2 or older. Loans taken will be free of current income tax as long as the policy remains in effect until the insured’s death, does not lapse and is not a MEC. Please note that outstanding loans accrue interest. Income tax-free treatment also assumes the loan will eventually be satisfied from income tax-free death benefit proceeds. Loans and withdrawals reduce the policy’s cash value and death benefit, may cause certain policy benefits or riders to become unavailable and may increase the chance the policy may lapse. If the policy lapses, is surrendered or becomes a MEC, the loan balance at such time would generally be viewed as distributed and taxable under the general rules for distribution of policy cash values. In addition, withdrawals, policy loans and any accrued loan interest may cause your policy to lapse even if you are in a period of coverage under the No-Lapse Guarantee Rider. Speak to your financial professional before taking any withdrawals or policy loans.

** This is provided through a Long-term Care Servicessm rider, which is available for a additional charge. Additionally, there are restrictions and limitations. A client may qualify for the life insurance, but not the rider. It is paid as an acceleration of the death benefit.

Life insurance is issued by Equitable Financial Life Insurance Company (Equitable Financial), New York, NY 10104; or by Equitable Financial Life Insurance Company of America (Equitable America), an Arizona Stock Corporation, with main administrative office in Jersey City, NJ. Equitable America is not licensed to conduct business in New York.) It is distributed by Equitable Network (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), LLC and Equitable Distributors, LLC. Variable life insurance is co-distributed by Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC. When sold by New York state-based (i.e., domiciled) Financial Professionals, life insurance is issued by Equitable Financial Life Insurance Company (New York, NY). Securities offered through Equitable Advisors, LLC (NY, NY 212-314-4600), member FINRA, SIPC (Equitable Financial Advisors in MI & TN). Annuity and insurance products offered through Equitable Network, LLC.

GE-4721140.1 (5/22) (Exp.5/24)